unlevered free cash flow vs fcff

Free Cash Flow For The Firm - FCFF. FCFF is the remaining amount for all the firms investors which includes bondholders and stockholders but FCFE is the amount that is left for common equity holders of the firm.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Operating cash flow measures cash generated by a companys business operations.

. Unlevered cash flow as leverage impact is excluded. They all treat interest expense and debt repayment differently. Unlevered free cash flow is visible to investors equity holders and debtholders in the company.

It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. You might also hear unlevered free cash flow UFCF referenced as free cash flow to firm FCFF. Unlevered FCF is cash flow available to everyone free cash flow to firm FCFF free cash flow available to equity AND debt holders.

However FCFE determines the equity value or the firm. Unlevered free cash flow can be reported in a companys. FCFE levered free cash flow.

Levered Free Cash Flow. What is Free Cash Flow to Firm FCFF. Levered cash flow as leverage impact is included.

Unlevered free cash flow. Free Cash Flow to Firm FCFF refers to the cash generated by the core operations of a company that belongs to all capital providers both debt and equity. It shows the cash that a company can produce after deducting the purchase of assets such as property equipment and other major investments from its operating cash flow.

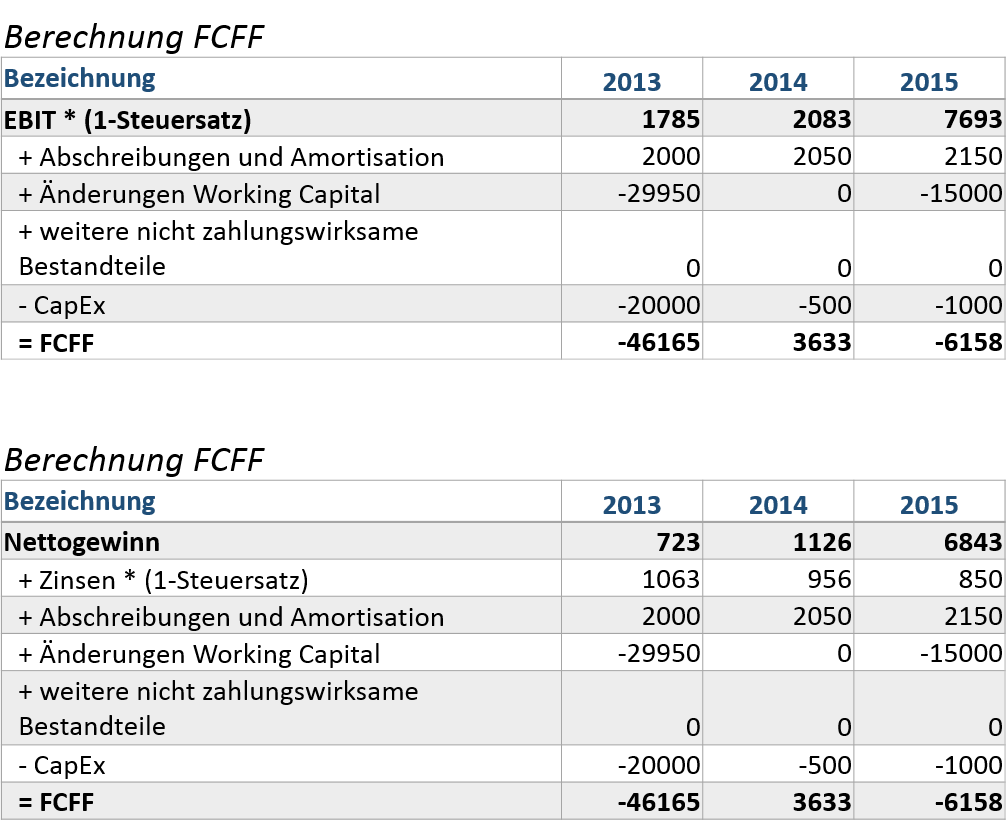

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. FCFF vs FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow. FCFF is not the same as CFO - CAPEX because Cash from operations starts with net income instead of NOPAT where NOPAT net operating profit after taxes is EBIT 1 - t.

Unlevered fcf is fcf to the enterprise ie the firm. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. When performing business calculations unlevered is a term that describes money that is available before financial.

Unlevered FCF is FCF to the enterprise ie the firm. Free cash flow FCF measures a companys financial performance. If Unlevered Free Cash Flows are being used the firms Weighted Average Cost of Capital WACC.

The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation. Net cash provided by operating activities 1176. LUnlevered Free Cash Flow UFCF anche conosciuto come Free Cash Flow to the Firm FCFF in italiano flusso di cassa disponibile per gli azionisti e i finanziatori rappresenta leffettivo flusso monetario cassa generato da una azienda o divisione tenuti in considerazione gli investimenti in capitale circolante e gli investimenti necessari alloperatività e al mantenimento.

The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF. Unlevered vs Levered Free Cash Flow. Cash flow is available to all the investors of a firm.

The difference between the two can be traced to the fact that Free Cash Flow to Firm excludes the impact of interest payments and net increasesdecreases in debt while these items are taken into consideration for FCFE. The difference between levered and unlevered free cash flow is expenses. Key Learning Points.

In other words FCF measures a companys ability to produce what investors care most about. Free cash flow to the firm is synonymous with unlevered free cash flow. Unlevered Free Cash Flow - UFCF.

5 Free Cash Flow to the Firm FCFF Free Cash Flow to the Firm or FCFF also called Unlevered Free Cash Flow requires a multi-step calculation and is used in Discounted Cash Flow analysis to arrive at the Enterprise Value or total firm value. Free cash flow for the firm FCFF is a measure of financial performance that expresses the net amount of cash that is generated for a firm after expenses. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115.

What Does Unlevered Mean. Levered beta contains the risk related to equity holder and debt holder Similarly FCFF is the one considering both equity and debt. To calculate our levered free cash flow for 2019 wed take the following in millions.

Unlevered Free Cash Flow is used in. The completed model output is shown below. Issuances of notes payable 62.

Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders. The major differences between free cash flow to firm FCFF and free cash flow to equity FCFE are as follows. Free cash flow is the cash that a company generates from its business operations after subtracting capital.

Unlevered Free Cash Flow. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company. Free cash flow to firm fcff refers to the cash generated by the core operations of a company that belongs to all capital providers both debt and equity.

Just like valuation multiples differ depending on the type of cash flow being used the discount rate in a DCF also differs depending on whether Unlevered Free Cash Flows or Levered Free Cash Flows are being discounted. In Discounted Cash Flow variation FCFF calculates the enterprise value or total intrinsic value of the firm. Cash flow is available for equity shareholders only.

Additions to properties -586. Includes interest expense but NOT debt issuances or repayments. Since yourre taking out interest expense all the free cash flow is available to equity holders.

FCFE Levered Free Cash Flow is used in financial modeling to determine the equity value of a firm. Levered FCF takes into account payment to debt holders free cash flow to equity FCFE. Looking at the cash flow statement from their latest 10-k we can highlight the following metrics.

FCFF unlevered free cash flow. Excludes interest expense and ALL debt issuances and repayments. Used interchangeably with unlevered free cash flow the FCFF metric accounts for all recurring operating expenses and re-investment expenditures while excluding all outflows.

Includes interest expense and mandatory debt repayments but opinions. Levered cash flow is the amount of free cash available to pay dividends the. Levered cash flow is the amount of cash a business has after it has met its financial obligations.

Free Cash Flow FCF is the amount of cash freely available to all capital providers.

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Unlevered Free Cash Flow Definition Examples Formula

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial